12 SEP 2024

Calls to clarify scope of Barratt "master developer" deal with Homes England

Calls to clarify scope of Barratt "master developer" deal with Homes England

This week the Government's housing delivery agency, Homes England, announced a joint venture agreement, the 'MADE' partnership, between Homes England, the largest housebuilder Barratt and the largest mortgage lender Lloyds. The new partnership is intended to provide skills relating to large site finding, master planning and master developing within a new commercial joint venture legal partnership which is benefitting from an injection of £50million of taxpayer cash.

It is undoubtedly the case that there is a scarcity of high quality master planner and master developer skills in the public sector. So with a big build commitment by the new Government, the question arises how to fill that capacity gap. Step forward the MADE partnership.

But hot on the heels of the announcement, there have been calls for Homes England to urgently clarify the scope and operational framework of the new partnership. One rival housebuilder is reported to have commented that "Homes England has put £50million of public money into a joint venture that seems to allow Barratt to get preferential access to more land and decide whether to build it out or sell it". Meanwhile, City analysts have praised Barratt describing the deal as "shrewd" for them and there was modest uplift in the share price of Barratt following the announcement of the Homes England deal.

Additional capacity for delivering new homes is always welcome. It is important that the public and private sectors work together to plan and deliver the homes our country needs. Homes England have a long record in entering into joint ventures in developments. However, this partnership is more unusual than many in its apparent geographical reach right across the country as well as its close alignment with the operational powers of Homes England, including access to public funding and planning consents.

It is vital that all hands are on deck in order to deliver the scale of the challenge to build 1.5million homes this Parliament. This will require a range of different ways of working to attract larger, smaller and new entrant participants, and a diverse range of funding sources and products. It's essential that Homes England retain the trust and confidence of a diverse and vibrant housing and finance market in order to meet the scale of housebuilding challenge, which includes clarifying the extent and operational framework of the MADE partnership so that any concerns may be readily addressed and opportunities for participation and collaboration made clear.

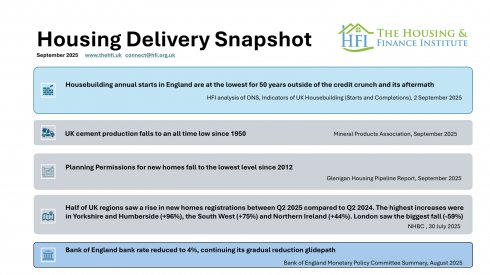

September 2025 Housing Delivery Snapshot

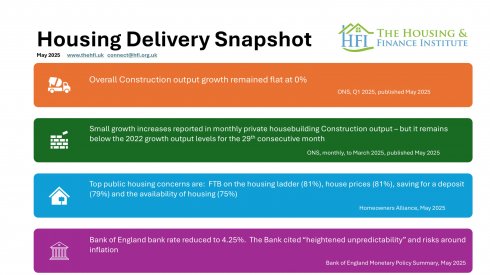

May 2025 Housing Delivery Snapshot

March 2025 Housing Delivery Snapshot

January 2025 Housing Delivery Snapshot

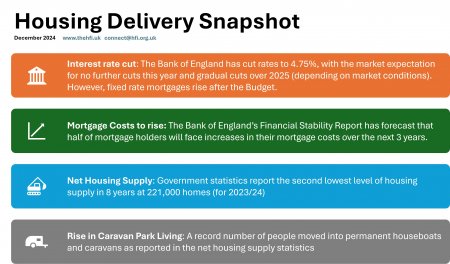

December 2024