30 OCT 2024

More Action Needed: Budget Response from the HFI

"More action needed on housing to fix the foundations and boost growth"

"More action needed on housing to fix the foundations and boost growth"

Sir Steve Bullock, Chair of the Housing & Finance Institute said:

"This Autumn Budget takes place against the backdrop of huge challenges to the public finances. The scale of the challenges to the public finances cannot be underestimated but the immediacy of the challenges for housing cannot be overstated either.

"Good housing is a fundamental part of strong foundations for the country. The impact of poor housing is not only personal but also macro-economic. Bad housing can destroy children's educational outcomes and have a long term detriment to economic wellbeing in adulthood. The impact of poor housing directly results in poor health outcomes and adds to the pressure on the NHS.

"While the Budget measures for social housing are welcome, more needs to be done to invest in housing right across the board. That investment is not just good for individuals, over time it will save money for the public purse and boost the economy too."

Natalie Elphicke Ross OBE, Director of the HFI said:

"There were high hopes for housing as an engine for growth. But there was too little focus on the importance of housing to driving economic growth in the Autumn Budget.

"Housebuilding numbers have been falling and these budget measures are not enough for the government to meet its targets. More action is needed to build the homes our country needs.

"It was good news to see right to buy reform and more money for social housing, which the HFI has been calling for. But the crisis in homelessness and temporary accommodation is costing councils over £2billion a year. More radical action is needed to tackle temporary accommodation and homelessness, like the HFI's Operation Homemaker plan."

NOTES

For more information about the economic and wellbeing importance of housing: see HFI's Time for Good Homes here

For more information about the HFI's plan to tackle homelessness and temporary accommodation: see HFI's Operation Homemaker:here

For more analysis about the Budget and HFI's recommendations on Right to Buy and social housing investment: see HFI's website: www.thehfi.uk

ABOUT THE HFI - Who, What, How

Who we are

The Housing & Finance Institute was established in 2015 with the support of UK Government, businesses and councils. Its creation was a recommendation of the Elphicke-House Report 2015. The HFI is a not-for-profit organisation.

What we do

The Housing & Finance Institute acts as an accelerator hub, to increase knowledge and capacity in order to speed up and increase the number of new homes financed, built and managed across all tenures.

How we work

At the HFI, we do the following:

share best practice through workshops, networking and our landmark 'Housing Business Ready' programmes, that support capacity building in councils to explore the housing their communities want and need publish policy papers engage across a range of stakeholders.

We are not politically affiliated with a particular party or business/industry.

Contact: natalie@hfi.org.uk connect@hfi.org.uk www.thehfi.uk

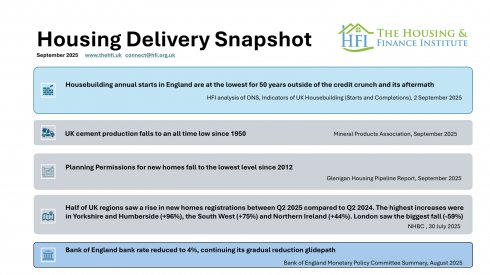

September 2025 Housing Delivery Snapshot

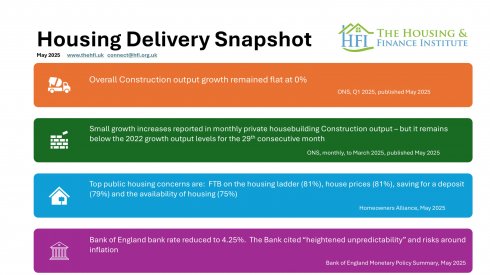

May 2025 Housing Delivery Snapshot

March 2025 Housing Delivery Snapshot

January 2025 Housing Delivery Snapshot

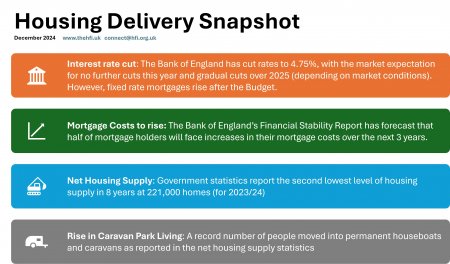

December 2024