26 NOV 2024

What's next for Older People's Housing?

What's next for older people's housing ?

What's next for older people's housing ?

With more of the population living longer, it's so important that there is an appropriate housing focus on good outcomes for Later Living Homes. So it's good to see a very well-constructed independent report released from the Older Peoples Housing Taskforce.

It is interesting that the report doesn't just focus on planning and design but also on financial barriers and consequences for individuals assessing whether to move into Later Living Homes and the business challenges for delivering, investing and managing Later Living Homes too.

There are some 'food for thought' recommendations around capital allowances, tax treatment of income from house sales and SDLT.

Questions are raised around whether the current tenancy/lease/licence framework is well adapted for longer term later living where services are provided, including the availability of "lifetime tenancies".

Analysis around the funding and investor consequences from relative lack of fluidity/ speed of take up in later living sales compared to the main market is a reminder that different parts of the housing development markets operate very differently. When considering speed of build out or attracting a range of housing providers to meet local needs, thought needs to be given to supporting effective delivery across the board.

The report recommends a number of further steps, including further detailed work on the issues which are raised. There is certainly opportunity for further innovation, structuring and regulatory changes to support this important segment of the housing markets.

Getting the business and investment environment right will be key to providing the attractive community environments and quality services outlined in the report in order to support the growing needs of a nation of people living longer.

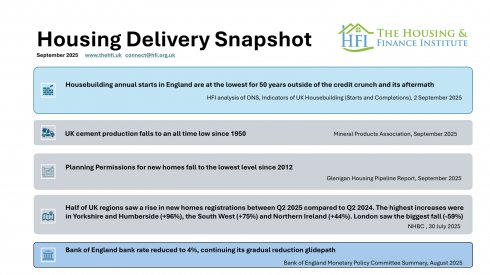

September 2025 Housing Delivery Snapshot

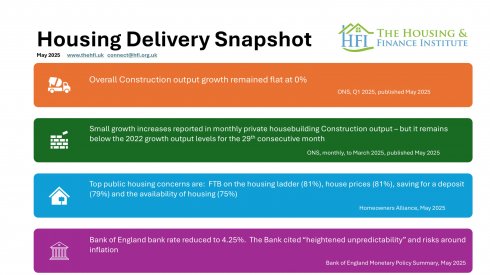

May 2025 Housing Delivery Snapshot

March 2025 Housing Delivery Snapshot

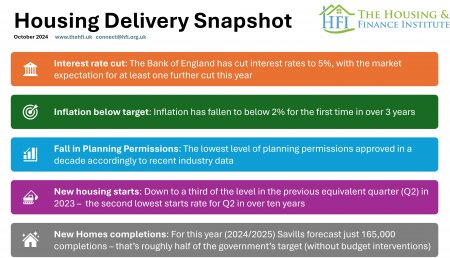

January 2025 Housing Delivery Snapshot

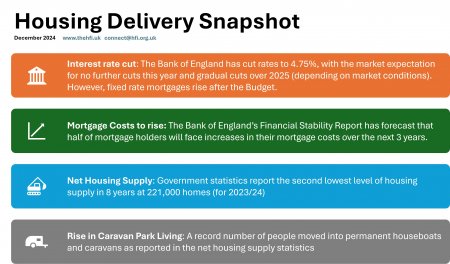

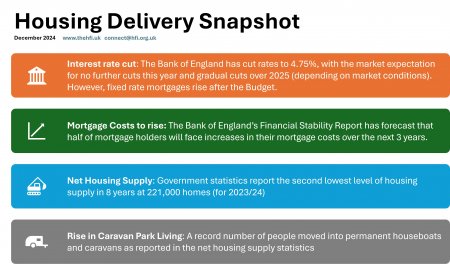

December 2024