20 JUN 2019

HFi Today, 20.06.19

Help to Buy

Today, the National Audit Office (NAO) released its latest report 'Help to Buy: Equity Loan scheme – progress review'. We at The Housing & Finance Institute were delighted to be able to contribute to the report, alongside other HFi membership organisations, at our recent Housing Accelerators' Forum.

Today, the National Audit Office (NAO) released its latest report 'Help to Buy: Equity Loan scheme – progress review'. We at The Housing & Finance Institute were delighted to be able to contribute to the report, alongside other HFi membership organisations, at our recent Housing Accelerators' Forum.

While the media claimed that the report was negative of the Help to Buy scheme, with a top-line based on individuals using Help to Buy when they don't need to; the report itself was far from the negative picture painted. In fact, the NAO's report was positive of the scheme and dispelled many of the myths associated with it.

Some of our top take-away points from the report were:

- 2031/32 is the year by which the Department estimates it will have recouped its investment in full.

- 81% is the proportion of Help to Buy loans provided to first-time buyers in England, at December 2018.

- The Department expects the scheme to support around 352,000 property purchases by March 2021, via loans totalling around £22 billion in cash terms.

- 63% of first-time buyers were aged 34 and under.

- The rate of building had increased by 14.5% because of the scheme.

- By comparing prices paid for similar new-build properties in the same area with and without the scheme, we estimate that buyers supported by the scheme have paid less than 1% more.

- The scheme is therefore delivering value so far against its own objectives - those objectives being to "deliver the homes the country needs", through increasing home ownership and increasing housing supply.

- The Department is currently forecasting a positive return on its investment and redemptions are running ahead of expectations.

The HFi's Chief Executive, Natalie Elphicke, appeared on talkRadio with Eamonn Holmes to discuss Help to Buy and the NAO's report. Natalie pointed out the good news from the report and the forthcoming changes to the scheme, which will target the equity loan at more specific groups.

Click here to listen to Natalie's segment on talkRadio in full.

Housing Business Ready Springboard Winners

Recently, the HFi hosted the HBR Springboard programme in partnership with the LGA. The winners of this competition will receive resource support from a range of partners and an opportunity to speak at the LGA Conference.

Recently, the HFi hosted the HBR Springboard programme in partnership with the LGA. The winners of this competition will receive resource support from a range of partners and an opportunity to speak at the LGA Conference.

We are delighted to announce that the Housing Business Ready Springboard winners are:

- Stoke-on-Trent City Council

- Mid Suffolk District Council

- Rotherham Metropolitan Borough Council

All three councils have a great deal of ambition of build more homes, faster, and have the vision required to turn this into a reality. To hear about their proposed sites and ambitions, please come along to the LGA conference to hear what they have to say.

LGA Conference

If you are in Bournemouth on 3rd July for the LGA Conference, come along to the HFi's 'Discussion with Drinks' at the Purbeck Bar of the Bournemouth International Centre, between 6-7pm.

If you are in Bournemouth on 3rd July for the LGA Conference, come along to the HFi's 'Discussion with Drinks' at the Purbeck Bar of the Bournemouth International Centre, between 6-7pm.

How do councils build more homes, faster?

Come along to a Discussion with Drinks, hearing from award-winning councils: Stoke-on-Trent City Council; Mid Suffolk District Council; and Rotherham Metropolitan Borough Council.

Councils are harnessing experience, expertise, investment and professional support to take forward housing developments. Meet the people who are delivering more homes on the ground and those helping them to turn a vision into reality. Working together with the public and private sectors will help us build the homes we need.

Housing & Finance Institute, Local Government Association, Homes England, Cheyne Capital, Savills and Trowers & Hamlins.

Chaired by Sir Steve Bullock DL, HFi Chairman and Mayor of Lewisham (2002-2018), and Natalie Elphicke OBE, Chief Executive of the HFi. We will also be joined by the current mayor of Lewisham, Damien Egan, and Darren Carter of Cheyne Capital.

Housing Delivery Summit

On 4th July, City & Financial are hosting their third Annual UK Housing Delivery Summit in London.

On 4th July, City & Financial are hosting their third Annual UK Housing Delivery Summit in London.

At the event, you will hear some of the most pressing themes impacting the UK housing market today, including:

- The future of the UK housing market – how can we accelerate delivery?

- The latest updates from councils after the recent announcements on scrapping the cap – what will the impact be on housebuilding and over what time frame?

- The role of infrastructure as a forward delivery mechanism

- Structuring schemes to ensure effective delivery – what will housing look like over the next 30 years?

- Financing housing and attracting institutional investors

The Housing Minister, Kit Malthouse MP, will be delivering the keynote address, and the HFi's Natalie Elphicke will be speaking on a panel about financing and innovation on housing delivery with investors from Man GPM and Greystar.

If you are interested in attending, City & Financial are offering a 30% discount to HFi subscribers. To take advantage of this offer, use the below discount code when registering to attend.

HDS4HFI

Click here to register

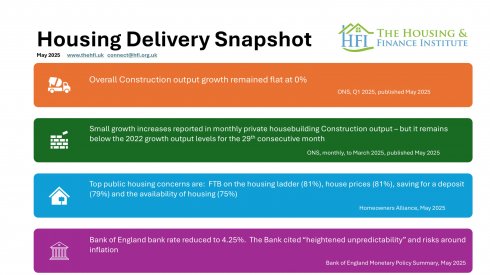

May 2025 Housing Delivery Snapshot

March 2025 Housing Delivery Snapshot

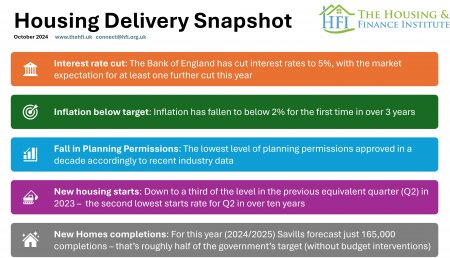

January 2025 Housing Delivery Snapshot

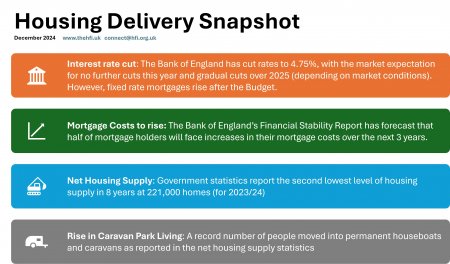

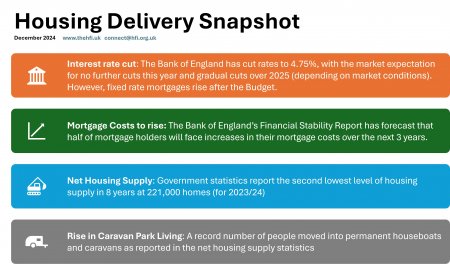

December 2024