29 JUL 2018

New Report by the HFi: A Time for Good Homes

A major new report today from the Housing & Finance Institute and housing association, Radian, reveals that the huge expansion in private renting over the last 15 years has severely harmed family and financial stability.

A major new report today from the Housing & Finance Institute and housing association, Radian, reveals that the huge expansion in private renting over the last 15 years has severely harmed family and financial stability.

They have collaborated to produce a ground-breaking report to set out the Four Pillars that underpins a Good Home. They are:

- Stability: a place to live in, in which to feel stable and secure.

- Flexibility: choices in how and where a person lives, in getting a different or better job or skills.

- Affordability: somewhere that is affordable at every stage of life and that enables savings. Supporting those most in need.

- Opportunity: a springboard for improved life chances.

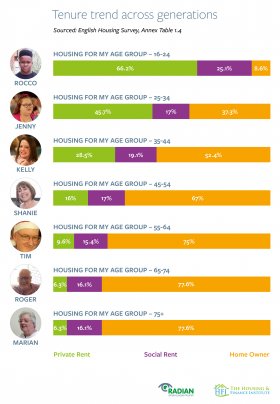

There are now 6 million more people living in private rented housing since 2002, with fewer and fewer Brits owning their own homes or living in social housing.

The Housing & Finance Institute/Radian report points to the direct link between good homes and a child's development – and highlights how the expansion of private rented accommodation has left young people with fewer opportunities.

The report cites international and national research, such as from the Intergenerational Commission, Resolution Foundation, Citizens Advice and Shelter that directly links good homes and standards of living, disposable income, family stability, tendency to commit crime, health and wellbeing, life expectancy and community engagement to the quality of housing.

On all counts better outcomes are achieved where people are living in good homes, particularly for health across all generations and children's educational attainment.

Furthermore, as well as damaging family stability and opportunity, poor quality homes and high-levels of private renting have failed to promote labour market mobility. The report finds that fewer people are moving than in previous decades. The expansion of the private rented sector has not resulted in greater labour market mobility or flexibility.

This fall in housing mobility has damaged the economy as fewer people are moving for work, especially younger people. It also means younger people are losing out on the wage boost that comes with labour market mobility.

Almost 4 million households currently in social or private rented housing expect that one day they will own their own home. However, over the last 15 years there have been more homes created in the private rented sector (2.56 million) than the total number of new households created over that period.

The HFI/Radian report says that a flagship Government policy, the expansion of the private rented sector, has exacerbated the bad housing crisis. They warn that the Government's recently announced new three-year tenancy plans may not help much either.

The paper is instead calling for more of the £44 billion housing budget to be prioritised in favour of helping young people get on the housing ladder and in delivering a larger, more flexible social rented sector.

In a ten-point plan of action for the Government, it is calling for an extension of help to buy, deposit loans for young people and a first home deposit tax allowance to help young people get on the housing ladder.

It also wants a market renewal programme to improve the standard of poor quality housing – and the auto-enrolment of landlords into a national landlord-licensing scheme in areas where there are high numbers of poor quality private-rented accommodation.

The Key Proposals

- New National Housing Delivery Commission

The Government should set up an independent National Housing Delivery Commission to produce a ten-year housing delivery plan based around the four pillars of a Good Home. The national housing delivery plan would include assessments of housing tenure, public and private finance, needs of different housing markets as well as the maintenance and safety of rented homes. It should be published and presented to Parliament for scrutiny.

- Direct Home Deposit Loans

A government loan of 10 per cent of the property price would double the number of people that can be helped through Help to Buy. The cost of the loan would be recovered through tax deductions.

- First Home Deposit Tax Allowance

A housing allowance tax scheme should be introduced where young home owners' mortgage interest can be deducted from tax. Housing tax rebates referenced to rental payments where the rebate of tax was paid directly into a housing ISA to contribute to a home deposit savings scheme would benefit younger renters.

- Extension of Help to Buy

The Help to Buy schemes have played a key role in helping people buy a home, with more than 80 per cent of first time buyers benefitting. When the current round comes to an end in 2021, it should be extended with a particular focus on the under 44 age group.

- New 90 per cent target for people living in Good Homes

Boosting the number of stable homes should be measured as a national target and the delivery of it should be a clear national priority. Alongside the Government's housing supply target of 300,000, there should be a commitment to increase the proportion of stable homes back to 90 per cent by 2035.

Click here to read the report

March 2025 Housing Delivery Snapshot

January 2025 Housing Delivery Snapshot

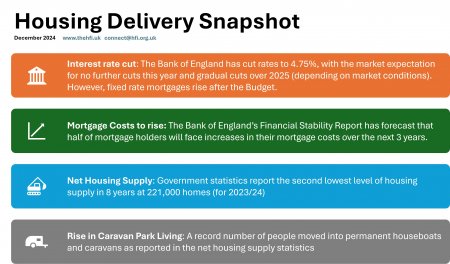

December 2024