21 AUG 2018

Recent Round-up 2

Podcast: Is home ownership the best policy for Britain

This week the HFi's Chief Executive, Natalie Elphicke, joined Blackstock MD, Andrew Teacher, and Phil Laney, founder and CEO of Lyvly, a co-living platform that helps renters find high-quality shared living accommodation. Phil and Natalie discuss whether home ownership is the best policy to solve the UK's housing crisis. This kicks off the run-up to the RESI conference.

Click here to listen to the podcast in full.

Siobhain McDonagh MP and the Green Belt

The HFi's Chairman and Chief Executive, Sir Mark Boleat and Natalie Elphicke recently met Siobhain McDonagh MP, the Labour Member of Parliament for Mitcham and Morden, to discuss the Green Belt. Sir Mark and Siobhain have a keen interest in the subject, with Sir Mark writing a report for the HFi on the Green Belt and Siobhain campaigning on the same issue.

Siobhain has started an Early Day Motion in Parliament on the Green Belt and submitted a response to the NPPF consultation. This received a large number of signatures from MPs and Peers from across the political spectrum, as well as many Think Tanks, Housing Associations, Trusts and academics.

In essence her proposal was that there should be a presumption in favour of permitting development of any land within one kilometre of a train station (TfL or National Rail) which provides access to London Zone 1 within a 45 minute travel time, unless certain limited exemptions applied.

You can read Sir Mark's paper on the topic in full here.

Conference Season

In addition to the CIH conference, as mentioned in our previous round-up newsletter, the HFi has also been busy at other housing conferences throughout the conference season - with more in the pipeline.

Natalie Elphicke spoke at the Spectator Housing Summit, she appeared on a panel alongside: Liz Truss MP; Clive Betts MP; Andy Hulme and Scott Barton of Lloyds Banking Group; Chris Carr, Homebuilders' Group; and Fraser Nelson. The session explored how we can unlock growth in the private sector to deliver the housing supply the UK needs – and what government should do to fulfil its promise to deliver a step-change in the provision of affordable homes.

In addition, HFi Board Member and former Mayor of Lewisham, Sir Steve Bullock, co-chaired the Enhancing Housing Services conference with our Chief Executive. The conference revolved around the theme of reshaping housing delivery & improving communities.

March 2025 Housing Delivery Snapshot

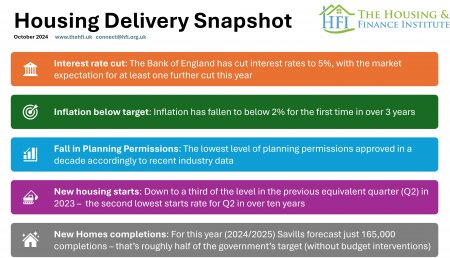

January 2025 Housing Delivery Snapshot

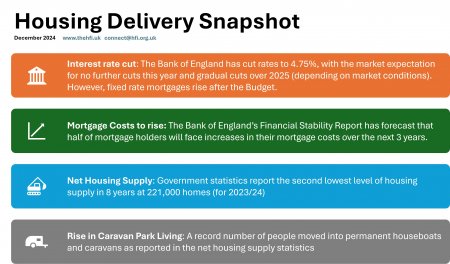

December 2024